How it works

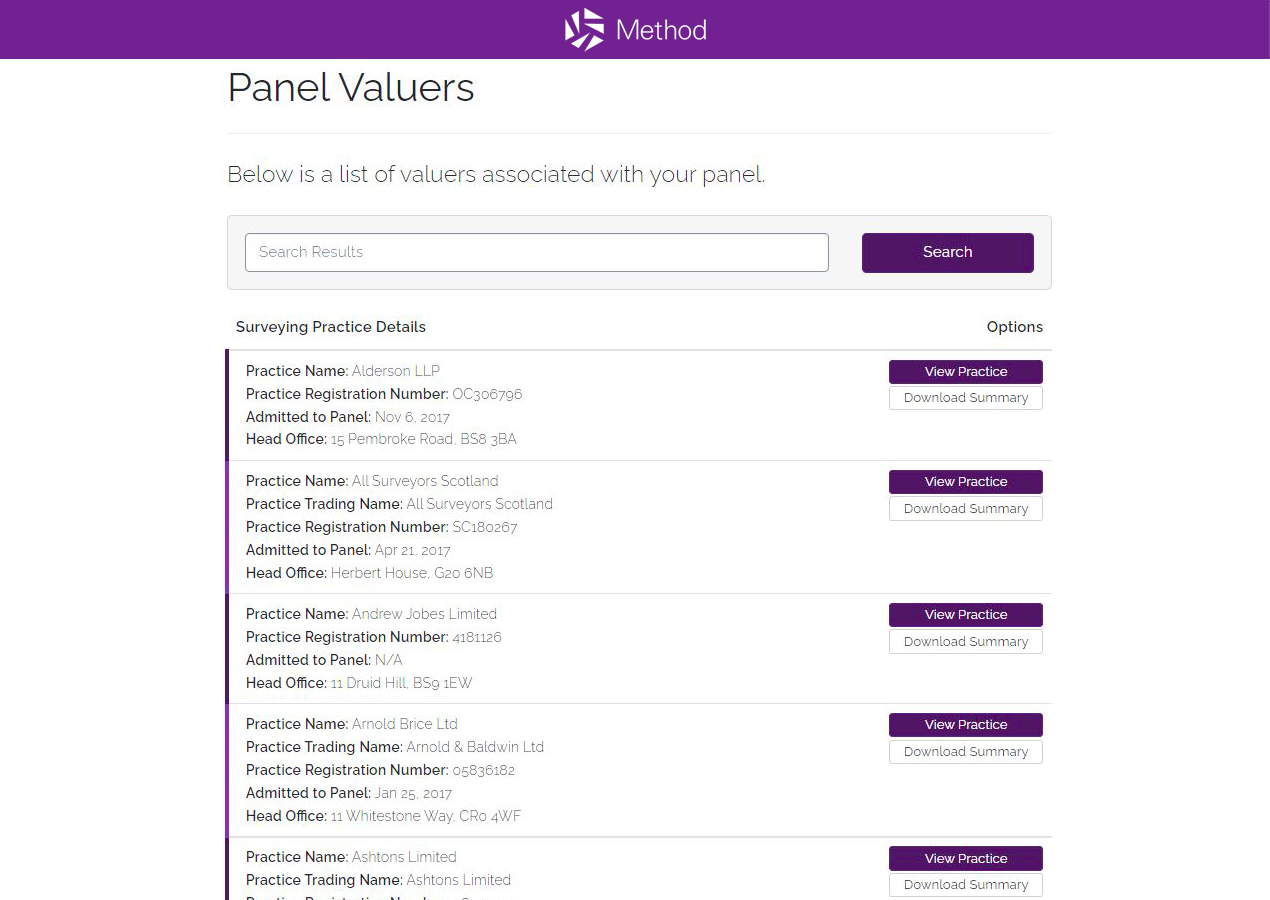

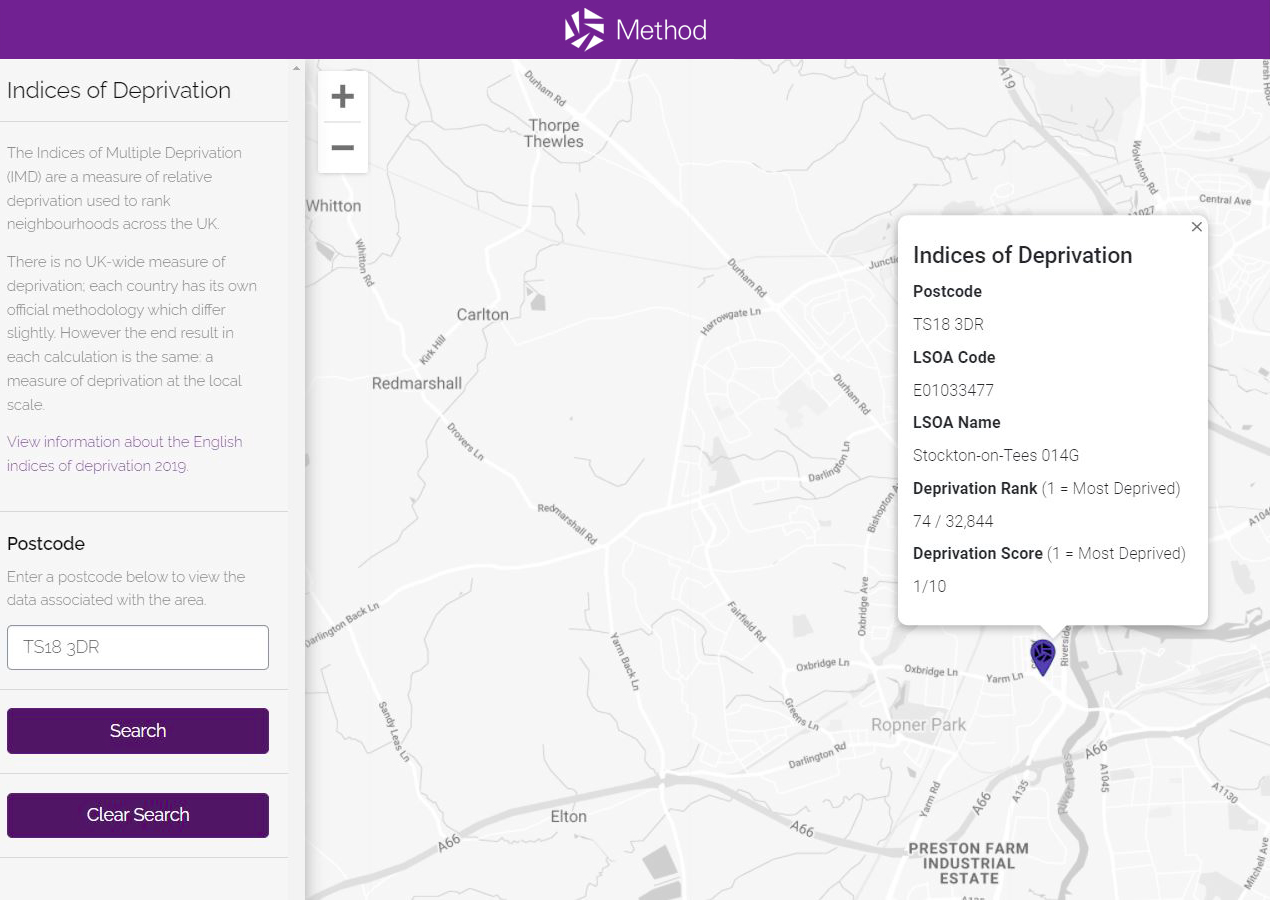

Lenders set their criteria

Establishing criteria such as the level of PII, number of company directors, how close to a property a surveyor should be based etc.

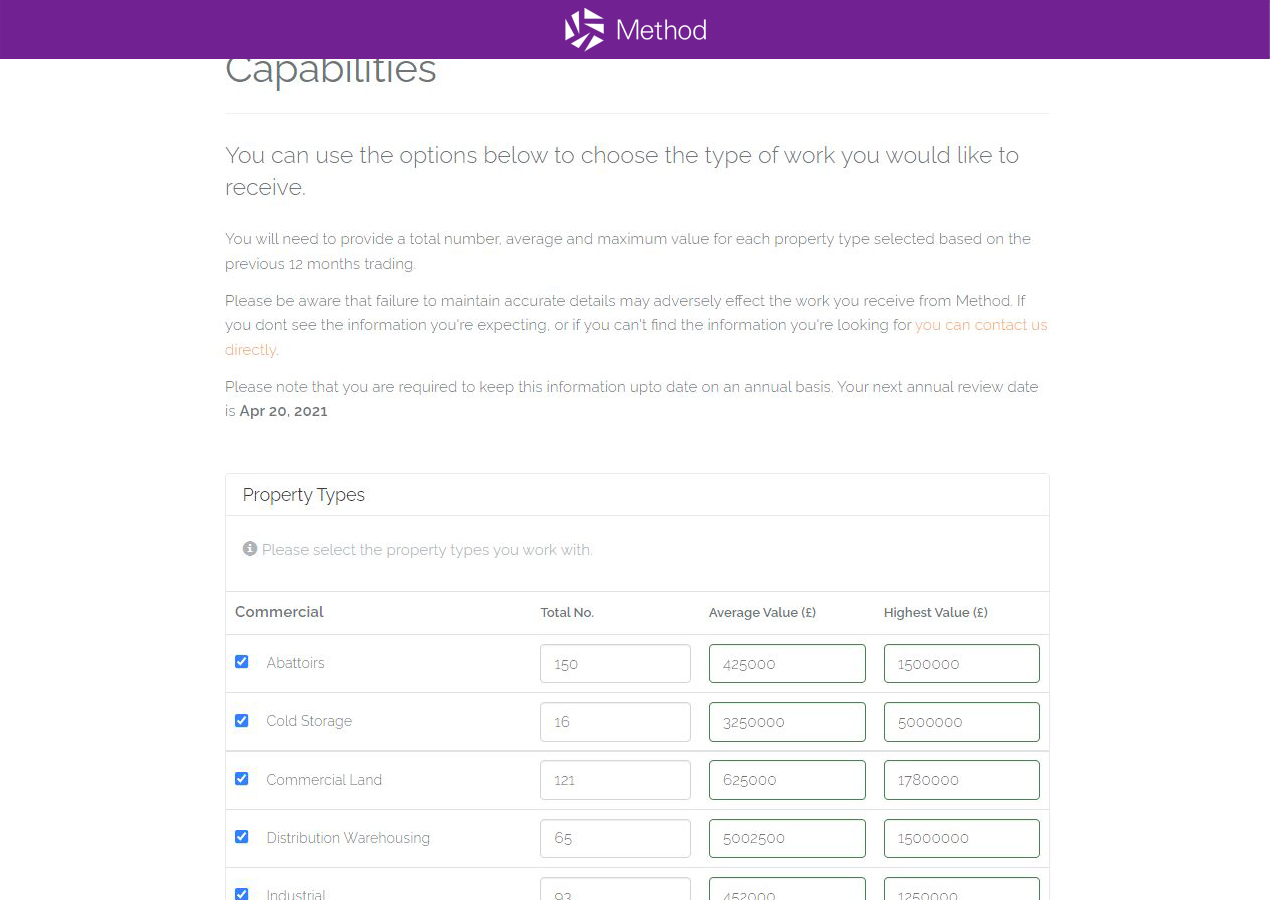

Property professionals set parameters

Valuation and IMS practices outline the type of work they wish to receive by market sector, property type and location.

Match

making

The systems’ algorithms select the most appropriate surveyors based on the parameters and criteria.

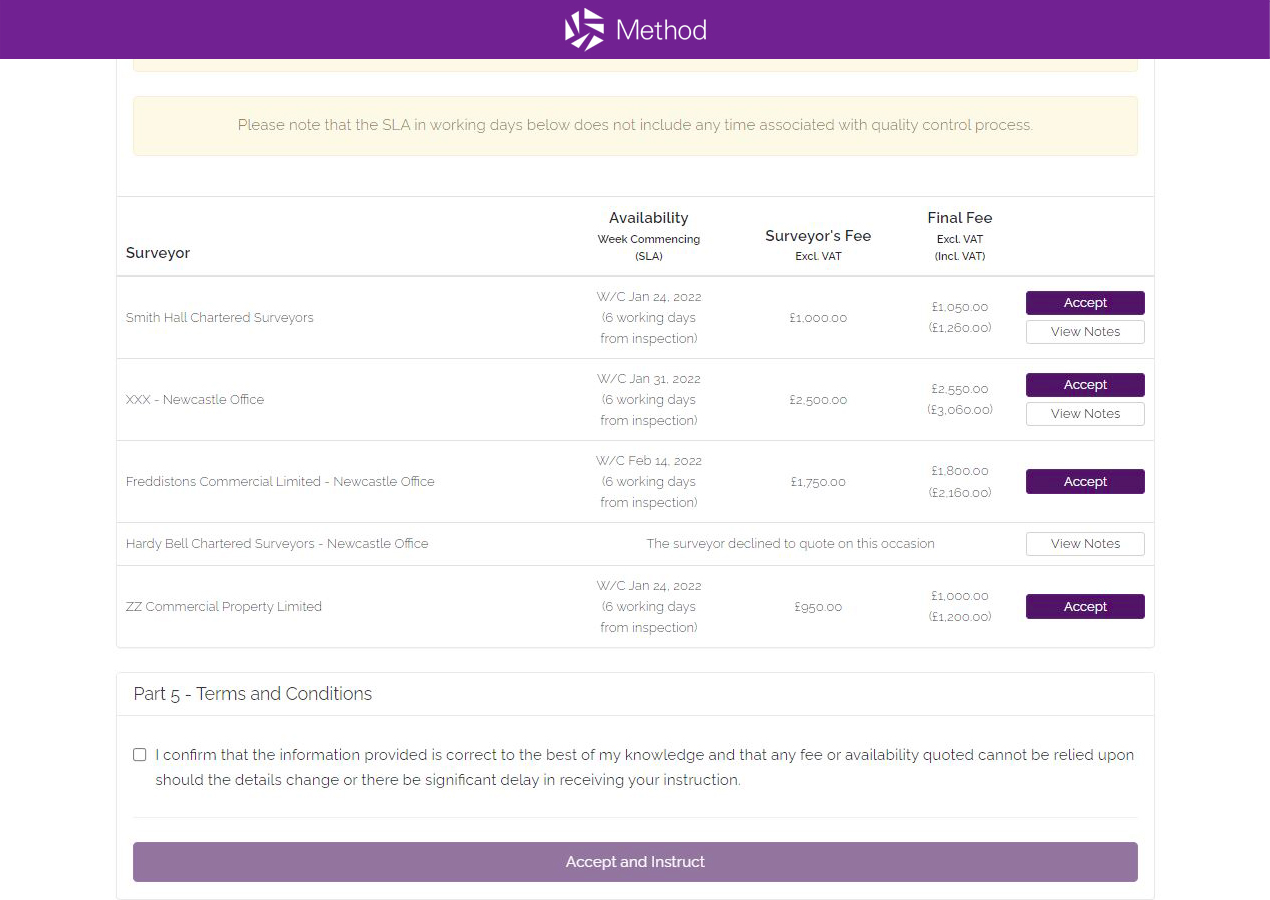

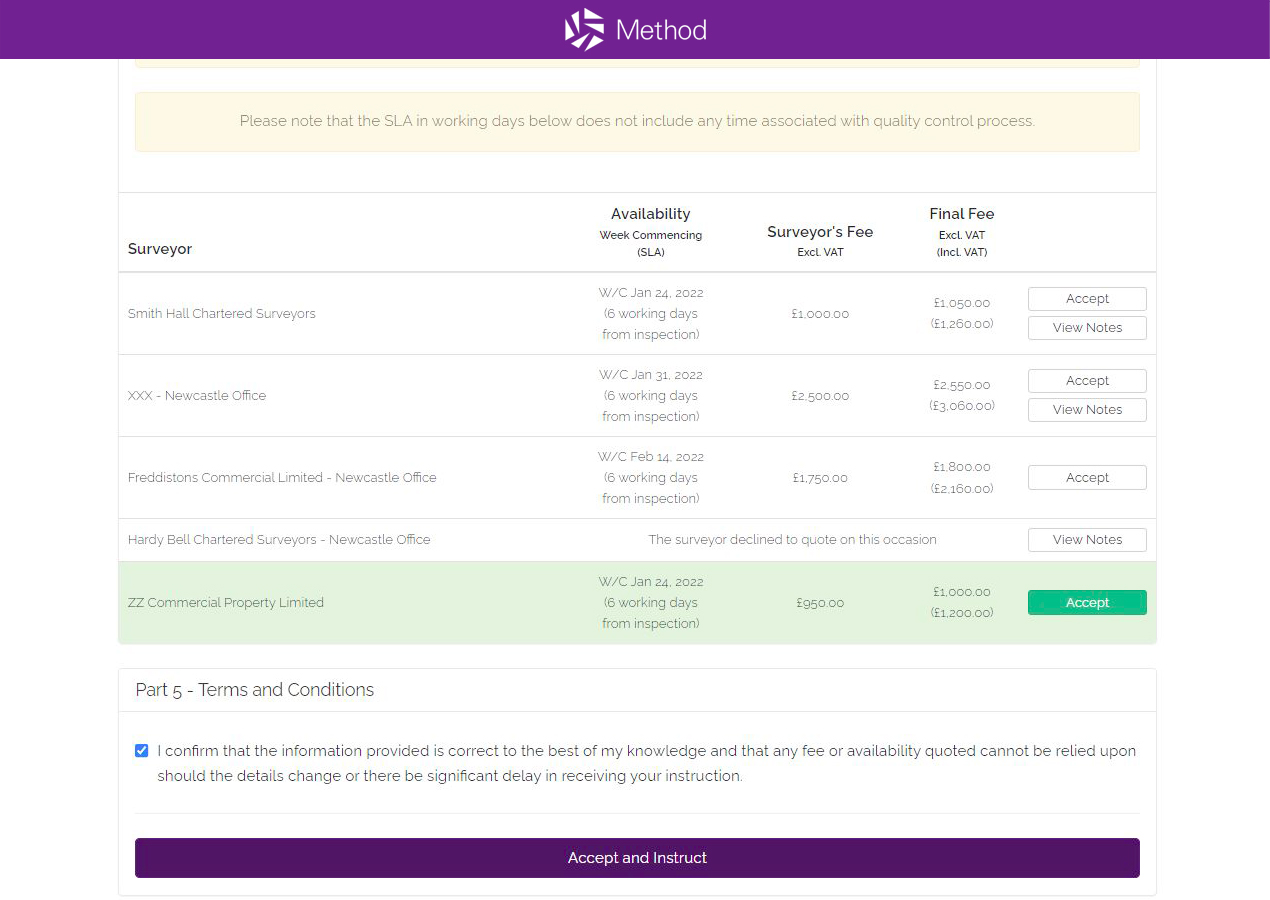

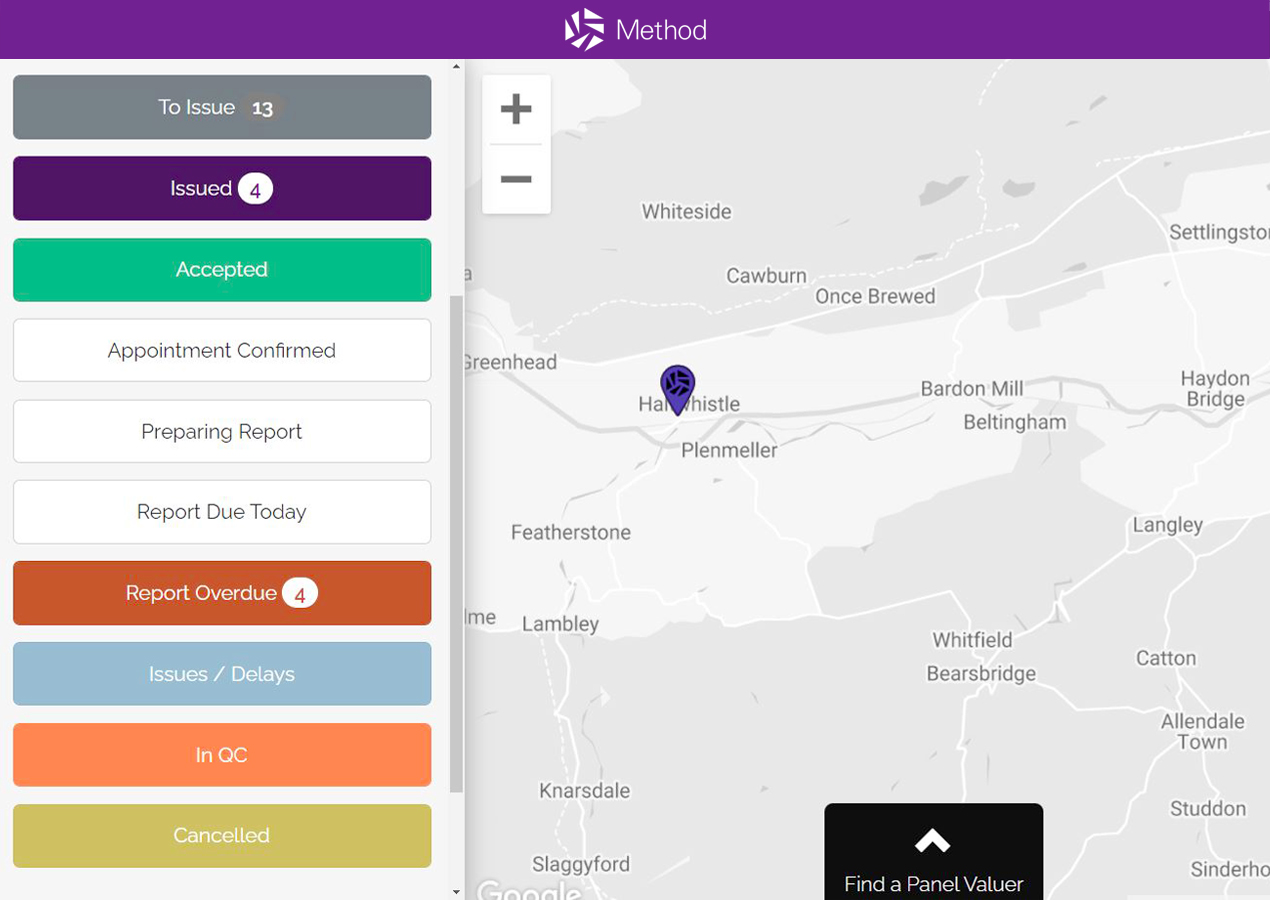

Quotation and instruction

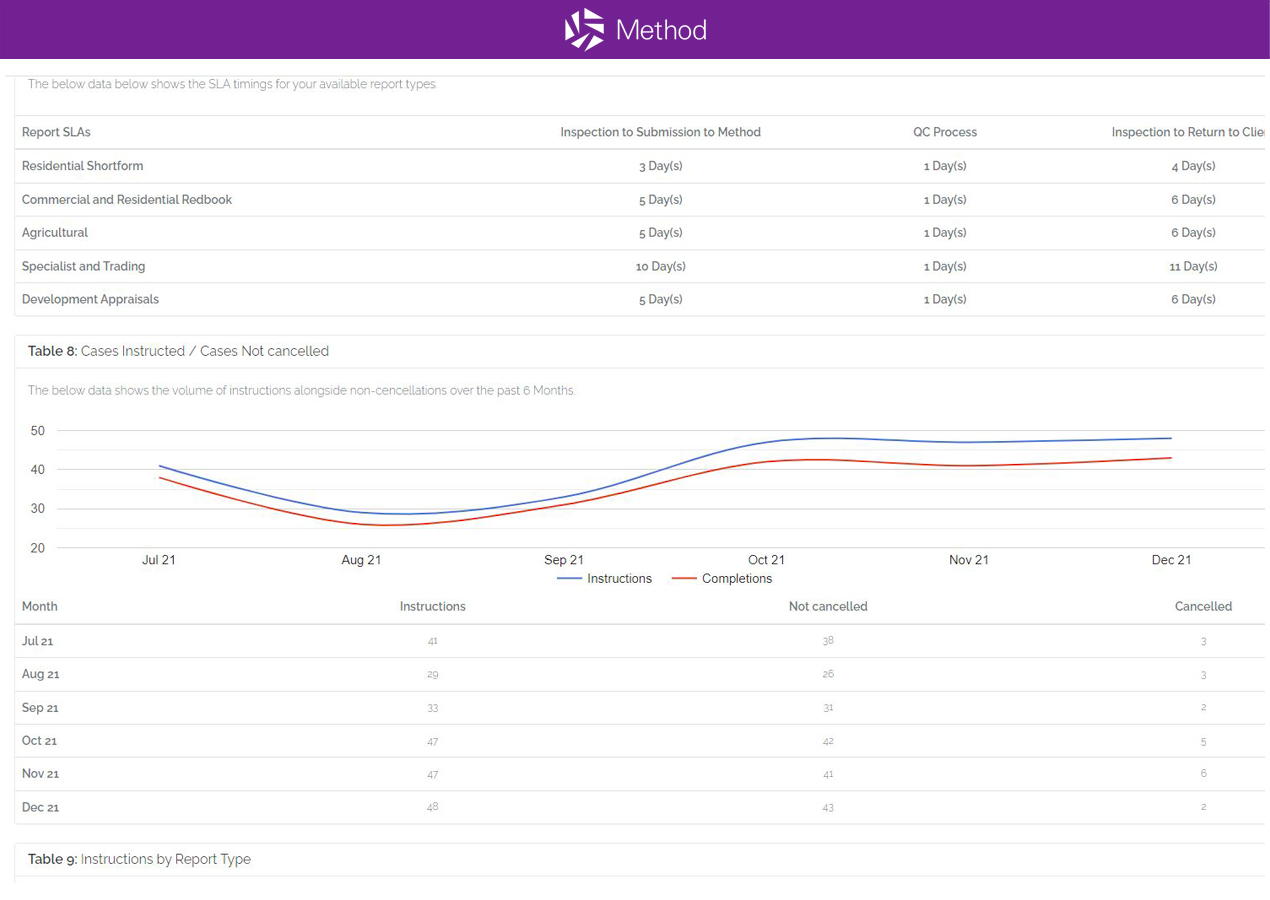

Suitable panel members are asked to provide a fee quote, confirm their availability and ability to meet SLAs. The lender chooses who to instruct.

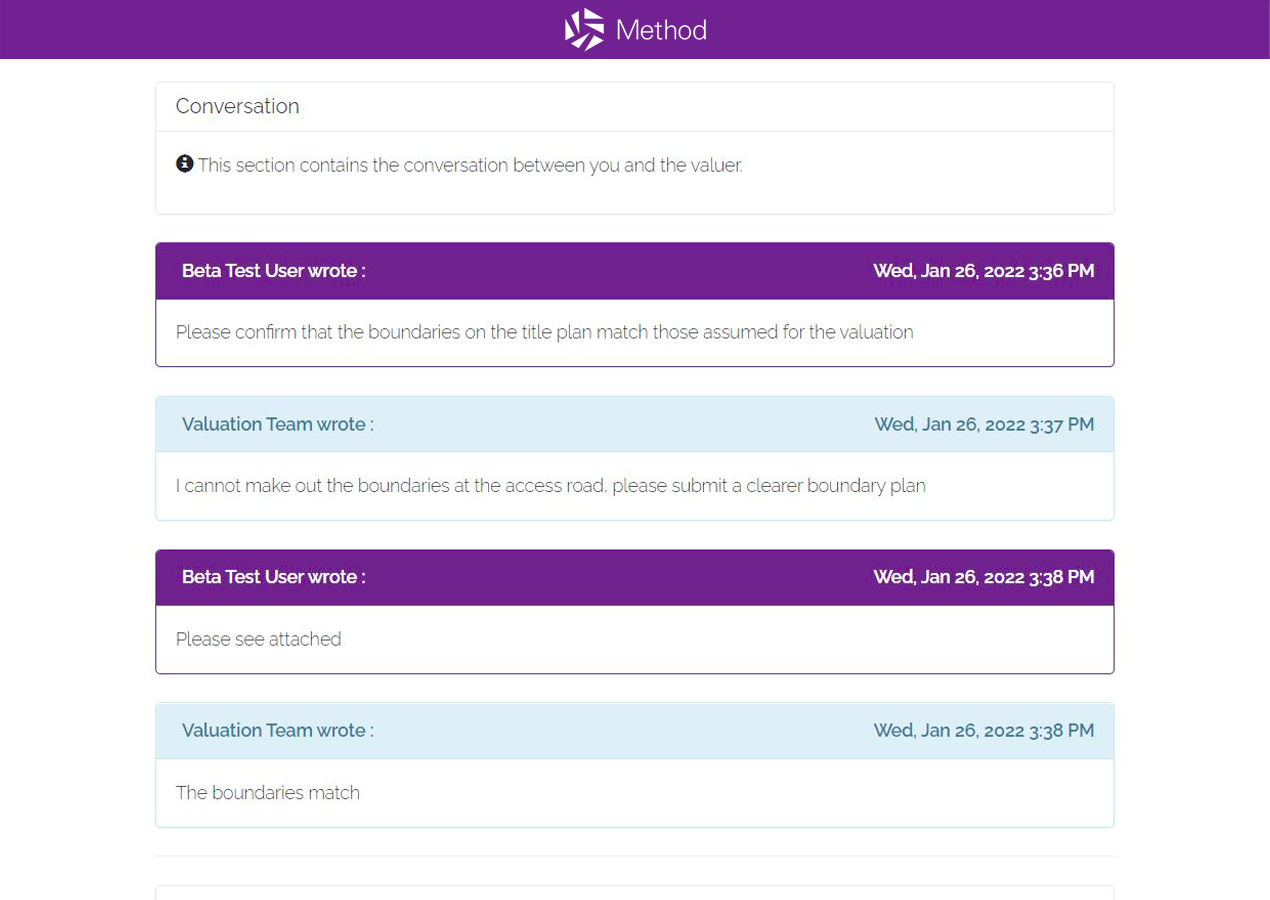

Reports & quality checking

If required, we provide Quality Control checks from suitably qualified RICS surveyors, to ensure compliance with the lender's requirements.